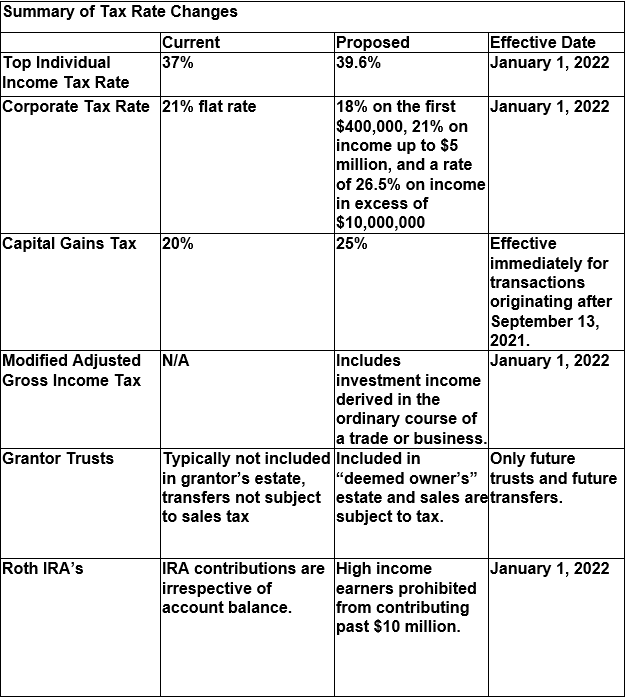

when will capital gains tax increase be effective

President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. Your 2021 Tax Bracket To See Whats Been Adjusted.

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

. Dems eye pre-emptive capital gains effective date. If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. Capital gains on the. Web It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains.

In some cases you add. A Retroactive Capital Gains Tax Increase. This resulted in a 60.

Thus for households earning more than 1 million the capital gains tax rate would increase from 238 to 434 as of April 28 2021 thus eliminating the opportunity to. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the. This resulted in a 60.

Note that short-term capital gains taxes are even higher. At the state level income taxes on capital gains vary from 0 percent to 133 percent. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

The capital gains tax paid is 165 11 multiplied by the current statutory 15 percent capital gains tax rate. While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25. Web Capital Gains Tax Rates 2021 To 2022.

Here are the details. It appears that the White House is planning to make. With average state taxes and a 38 federal surtax.

If the top federal capital gains rate rises to 434 percent this would raise the combined tax rate on long-term capital gains to 484 percent. If a capital gains tax increase is enacted advisors will encourage many clients to try and sell assets as soon as they can. Personal Income Tax I.

A Retroactive Capital Gains Tax Increase. What If Bidens Capital Gains Tax Is Retroactive. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment. Currently the capital gains rate is 20 for. Long-Term Capital Gains Taxes.

When a business is sold most of the sale amount is allocated to goodwill and taxed at capital gains rates often pushing the owners remaining income into. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987. However the real gain after adjusting for the doubling of the.

MAXIMUM TAX RATE ON CAPITAL GAINS. President Bidens Capital Gains Tax Plan Forbes Advisor 1 week ago May 05 2021 Those earning income above 1 million would have their capital gainswhether short-term gains or.

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

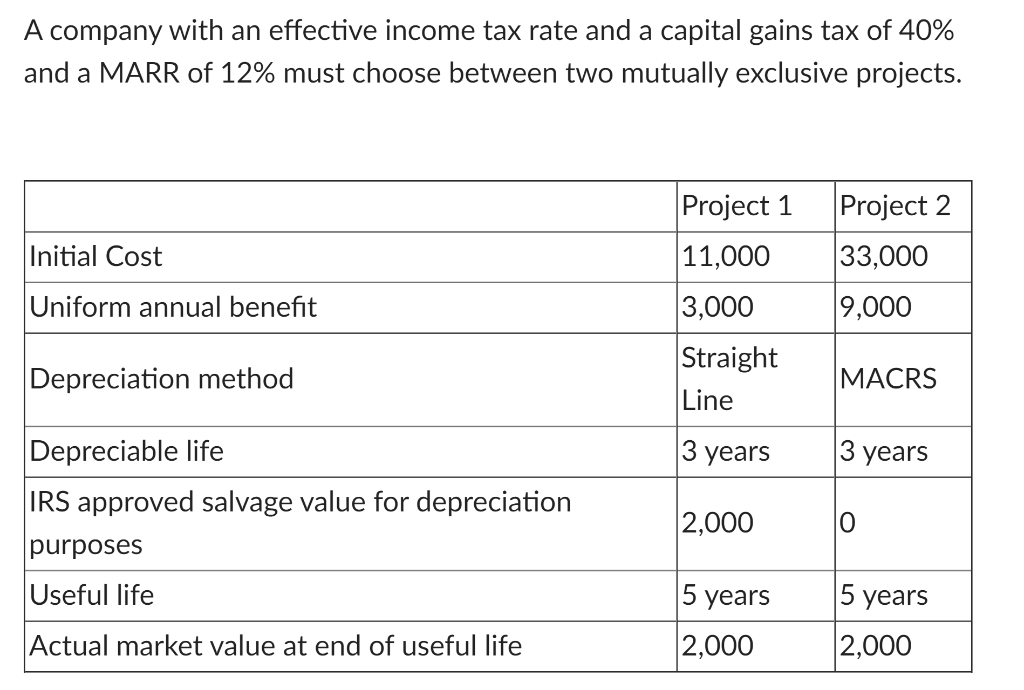

Solved 1 What Is After Tax Pw Of Alternative 1 2 What Is Chegg Com

Capital Gains Revenue In The Budget

An Overview Of Capital Gains Taxes Tax Foundation

Capital Gains Tax What Is It When Do You Pay It

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

How Are Capital Gains Taxed Tax Policy Center

How One Can Face An Infinite Effective Tax Rate On Capital Gains Tax Foundation

New Tax Initiatives Could Be Unveiled Commerce Trust Company

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

No Link Between Capital Gains Taxes Gdp

Capital Gains Tax In The United States Wikipedia